College Calls…

Sixteen years later and your Blissfully Single Girl Beans has a son going into his junior year of high school. College now calls; and as a mother, I have to contribute to the education of my son. The stark reality hit me, I have to shift gears to be that saving money mom for my children. Now not only is there college, but he’ll need a car soon, prom is coming up; I’m going to need to get that bank account ready for these expenses.

Saving Money as a Single Parent

As a single mother; I’m on one income. While, I do receive child support here and there (it’s NEVER consistent) the amount is very little as it literally covers groceries and maybe haircuts for the boys. So with mortgage, bills, car payments, children’s expenses, all on my shoulders, how does a single parent on one income manage to save money?

Saving money on one income isn’t easy, but it’s definitely possible!

As a single parent, the best way to save money is: drumroll please! By saving incrementally. Yes, saving in small, achievable amounts over a period of days will lead to big gains. There are different strategies you can use, read on!

Saving Money in Increments

Saving money in increments means that you’re saving in small amounts. Overtime, these small amounts add up. Before you know it, you have a really nice nest egg and the journey to getting there? Painless. Saving money incrementally is how saving money is made easy.

Strategies for Saving Money Incrementally

There are a lot of ways to save money incrementally.

Printable Savings Challenges

Printable Savings Challenges are one of the most popular ways of saving money in small amounts.

Essentially, these are charts created for you to save large sums of money, broken down into smaller amounts. You simply print the sheet and every time to save an amount, you mark the amount off the chart. It makes saving fun because you’re actively engaged in the savings process.

Here’s an example of what a savings printable looks like:

There are so many amounts you can try $1000, $5000, even $20,0000…it all depends on what your savings goals are. I’m saving for college, so right now, I’m at the $10K plus challenges.

Again, this is a fun and engaging way to save. Would you like to try this saving strategy? Please visit my store on the blog for the different versions I offer.

STASH Your Money Away

STASH is an investing app designed to help build wealth by allowing you to purchase fractional shares of a company. However, I actually use STASH to help me save and here’s how.

After investing with STASH, I realize the app has a banking feature. You can open an account and keep money there. Once the account is open, a debit card goes in the mail.

This is what I did. I opened an opened an account with STASH, only for the purposes of saving.

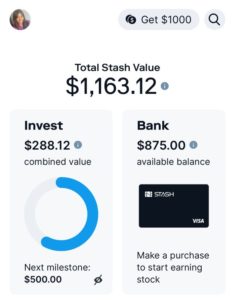

Once I received the debit card – I put it away as to not tempt me to use it. Since opening the account, I’ve saved in daily increments, starting from $1.00. Day two is $2.00. Day three is $3.00.. you get the drift, LOL. I’m not yet halfway to my end number and have already managed to save a decent chunk of change:

This system works great for me in saving money, but even if using STASH to save isn’t your cup of tea, I’d definitely suggest opening an account to help build wealth; investing is key. You can find out more about opening an account with STASH here.

Envelope Savings Challenge

Like the name would suggest, you’re saving incrementally and placing the money in an envelope. While I know many use this savings method, but, this one probably isn’t my favorite.

First, I’ve tried it before and it was way too easy to spend the money. If the guy who cut my grass showed up? I’d use that envelope money with a mental note to replace it; guess what? I never did. It makes saving a lot harder because there’s easy access.

Plus, if, unlike me, you’re disciplined and manage to save a large sum of money, it’s not best practice to keep large amounts of cash in the house. Anything can happen.

Nevertheless, I do know a lot of folks (particularly older people) who swear by the envelope method.

Cooperative Money Saving

As a woman of Haitian descent, I’d be remiss if I didn’t include saving within a group.

Commonly practiced by Caribbean’s, Africans, and South Americans, this kind of cooperative saving, known as Sous-Sous, involves a group of people contributing a set amount weekly. Once a week has passes, one person receives the lump sum amount from all contributing members.

This is not a pyramid scheme as everyone puts in a set amount and adheres to the payment schedule. I’ve seen many successes as I know people who have used this kind of savings to pay for a wedding, use for a down payment, or help finance the cost of college.

One word of caution though, these have to be trust worthy individuals. Myself, along with so many others have been stolen from in the process. I only do this with family now.

Also, once a payout is received, I highly advise a person saving in this way to follow up on the tax code to ensure proper taxes are being paid out on the lump sum.

The Blissfully Single Lesson

The blissfully single lesson?

As single parents, we need to be EXTRA on top of saving. Most of the time, our children only have us to rely on to help with the costs of college. Even more so over and above this, should disaster strike, we’re on one income, there’s no one else to lean on. Saving is even more vital for us.

A saving money quote reads: “The art is not in making money, but in keeping it.” We can keep the money we earn if we save in small doses.

Happy savings friends!

Blissfully Single and Yours,